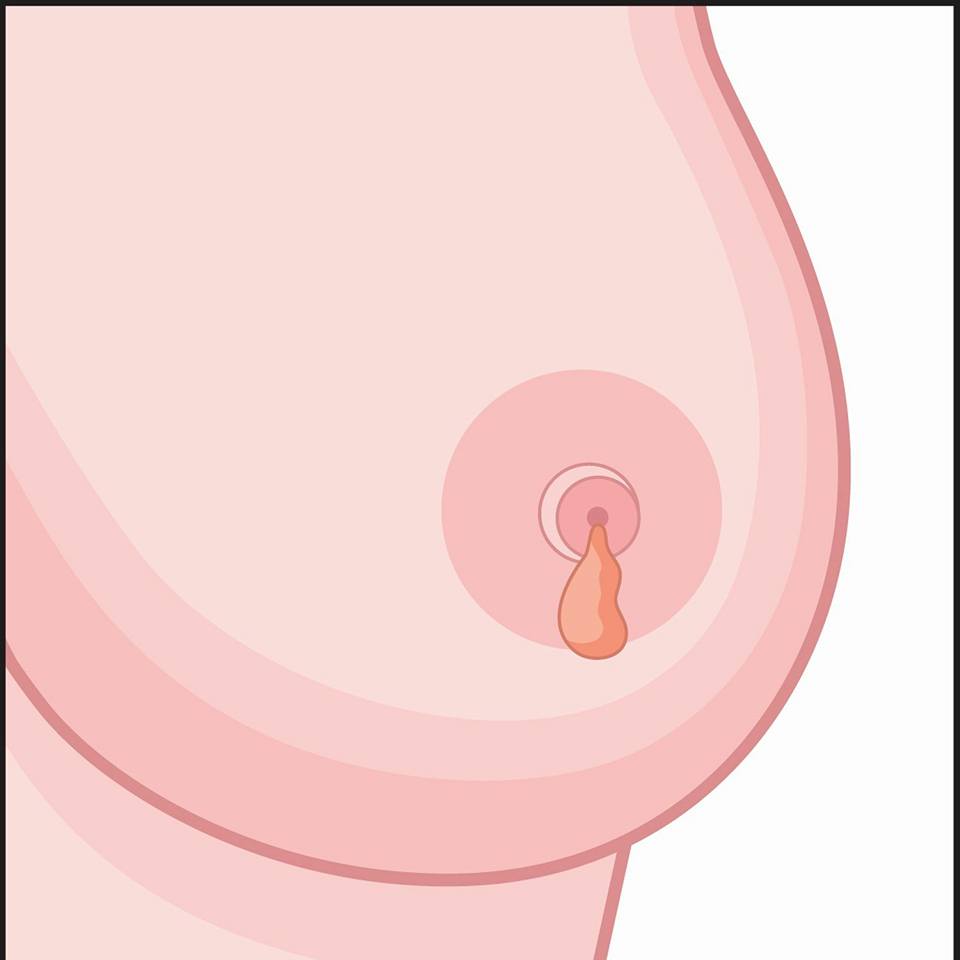

Breast discharge, or milky feminization fluid, is a common occurrence in women of all ages. This clear, white discharge is produced by the female reproductive system and can vary in consistency from light and watery to thick and pasty.

Breast discharge can occur at any time during the menstrual cycle but typically increases around ovulation. Although breast discharge can be uncomfortable and may cause some discomfort when it's wet, it's generally not harmful. If you're concerned about your breast discharge, talk to your doctor. You can also search online to know what is breast discharge.

Image Source: Google

What Are the Symptoms of Breast Discharge?. Although breast discharge can cause some discomfort, there are no symptoms or warning signs that it's time to call your doctor. The amount of breast discharge varies from day to day. Most women notice a build-up around ovulation and discharge may increase as a result of hormonal changes during perimenopause or menopause.

Signs of Breast Cancer

When women experience breast discharge, it is not always a sign of cancer. However, if the discharge is persistent or comes with other symptoms like soreness, pain, or swelling in the breasts, it might be a sign that something is wrong. Breast cancer can sometimes cause heavy discharge, but it is not the only cause. You can even search online for more information about breast discharge.